Rachel Springall, Finance Expert at Moneyfacts, said:

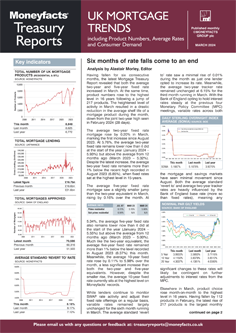

“Mortgage product availability was volatile during February as the average shelf life of a deal plummeted to just 15 days, a six-month low. Lenders reacted to the change in swap rates, leading to numerous repricing of fixed rate deals, no doubt making it a challenging situation for borrowers and brokers to keep on top of the changes. The rate volatility led to a rise in both the overall average two- and five-year fixed rates, the opposite direction borrowers may well have hoped for after positive rate cuts recorded a month prior. However, it is worth noting that fixed rates remain lower than at the start of 2024 and there are still some decent options available for borrowers to compare.

“Mortgage choice recorded the biggest month-on-month rise in six months, with mortgage options for borrowers overall breaching 6,000, the largest count in 16 years (March 2008 – 6,192). A deeper dive into the loan-to-value sectors reveals good news for borrowers with limited deposits. Indeed, product choice at 90% loan-to-value rose by 80 deals month-on-month, now at its highest count in four years (March 2020 – 779). This is a positive move, as choice dipped a month prior (February 2024 – 681). Those borrowers with just a 5% deposit will also find a rise in choice, as there are now over 300 deals on the market at 95% loan-to-value, the highest count since June 2022 (347). However, prospective first-time buyers still have affordability challenges to overcome amid volatile house prices and a lack of affordable housing before they even consider that the average rates on a two-year fixed deal at 90% and 95% LTV sit at 5.99%.

“As fixed mortgage rates rise, borrowers may wish to wait and see whether these rates will come back down in the weeks to come, but they must keep in mind that there is still an incentive to switch away from a Standard Variable Rate (SVR). All eyes are on the Monetary Policy Committee and their future rate setting, in conjunction with the swap rate market, as to whether mortgage rates will come down this year. Borrowers would be wise to seek advice if they are looking for a new deal, particularly as the shelf life of a product remains so unpredictable.”

Rachel Springall, Finance Expert at Moneyfacts, said:

“Mortgage product availability was volatile during February as the average shelf life of a deal plummeted to just 15 days, a six-month low. Lenders reacted to the change in swap rates, leading to numerous repricing of fixed rate deals, no doubt making it a challenging situation for borrowers and brokers to keep on top of the changes. The rate volatility led to a rise in both the overall average two- and five-year fixed rates, the opposite direction borrowers may well have hoped for after positive rate cuts recorded a month prior. However, it is worth noting that fixed rates remain lower than at the start of 2024 and there are still some decent options available for borrowers to compare.

“Mortgage choice recorded the biggest month-on-month rise in six months, with mortgage options for borrowers overall breaching 6,000, the largest count in 16 years (March 2008 – 6,192). A deeper dive into the loan-to-value sectors reveals good news for borrowers with limited deposits. Indeed, product choice at 90% loan-to-value rose by 80 deals month-on-month, now at its highest count in four years (March 2020 – 779). This is a positive move, as choice dipped a month prior (February 2024 – 681). Those borrowers with just a 5% deposit will also find a rise in choice, as there are now over 300 deals on the market at 95% loan-to-value, the highest count since June 2022 (347). However, prospective first-time buyers still have affordability challenges to overcome amid volatile house prices and a lack of affordable housing before they even consider that the average rates on a two-year fixed deal at 90% and 95% LTV sit at 5.99%.

“As fixed mortgage rates rise, borrowers may wish to wait and see whether these rates will come back down in the weeks to come, but they must keep in mind that there is still an incentive to switch away from a Standard Variable Rate (SVR). All eyes are on the Monetary Policy Committee and their future rate setting, in conjunction with the swap rate market, as to whether mortgage rates will come down this year. Borrowers would be wise to seek advice if they are looking for a new deal, particularly as the shelf life of a product remains so unpredictable.”