Eleanor Williams, Finance Expert at Moneyfacts, said:

“Following a statement from the FCA last week urging eligible borrowers to consider their mortgage options and switch to a more cost-effective deal in order to save money where possible, Moneyfacts data shows that those considering a new mortgage may wish to move swiftly to achieve this.

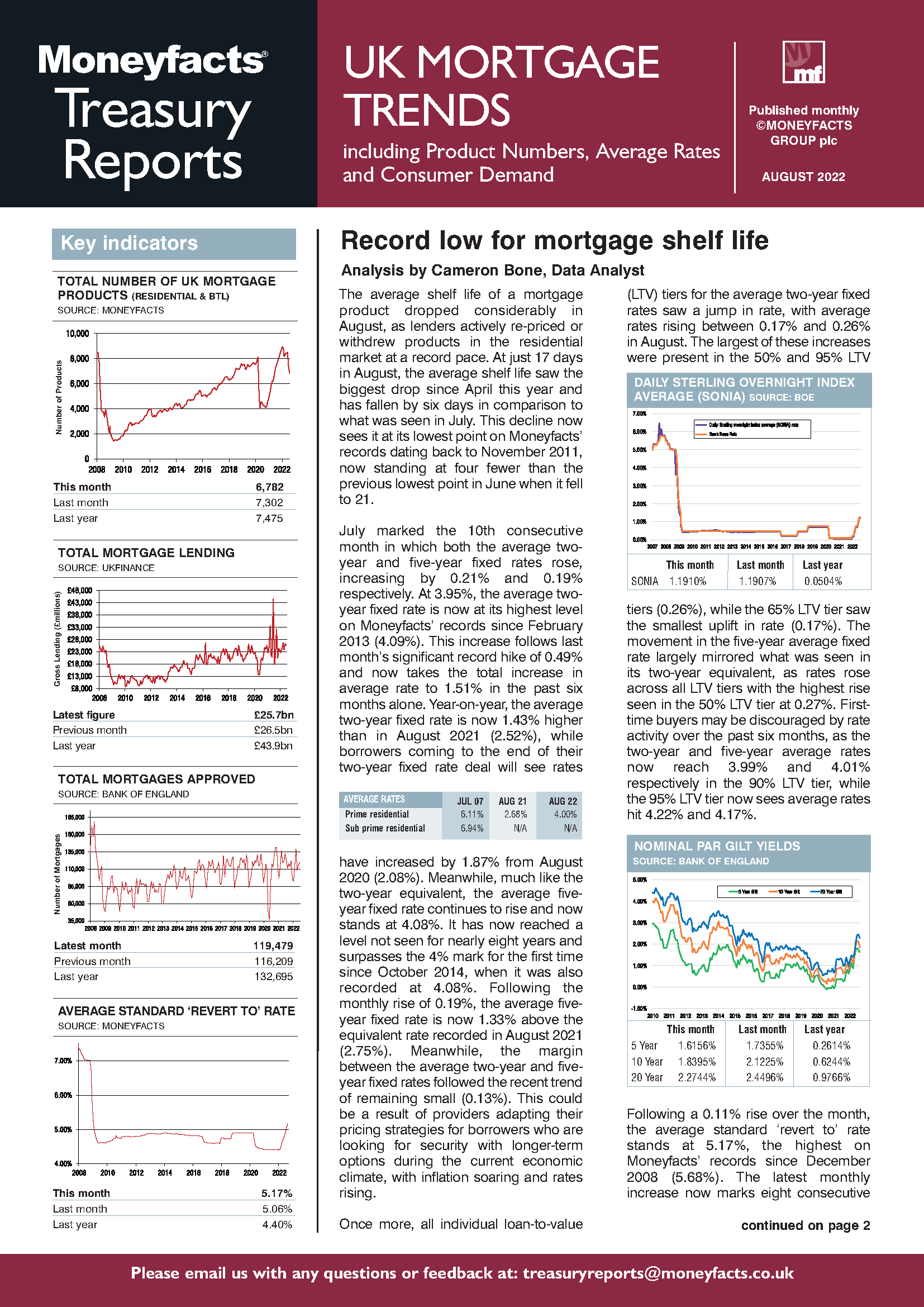

“Mortgage availability has dropped again this month, admittedly reducing at a less dramatic rate than recorded last month. August began with sight of 4,407 mortgages on offer, which is 149 fewer than were available at the start of July, meaning that the level of choice for borrowers has fallen again. Not only are there now fewer deals for borrowers to choose from, but the average shelf life for mortgage deals has plummeted to a new low of just 17 days this month. This reflects the speed at which providers are updating their offerings, but also means that those looking for a new mortgage have the shortest length of time we have ever recorded to try to secure their deal of choice.

“Would-be borrowers will also note that the rates on offer are continuing to climb. The average overall five-year fixed rate mortgage has breached 4% for the first time in nearly eight years, reaching 4.08% this month, a high not seen since October 2014 (4.08%). The average two-year overall rate, currently 3.95% after another month-on-month increase, is the highest recorded in over nine years (Feb 2013 – 4.09%). However, the average SVR has also climbed, this month rising by 0.11% to 5.17%, so while the differential between this and the average fixed rates now available has shrunk, it’s clear that those on, or about to revert to an SVR, could save on their monthly mortgage repayments if they are able to lock into a new fixed deal.

“The amount a borrower might be able to save on a new mortgage will depend on many factors, and it’s important consumers remember that average rates reflect what’s available across the whole of the market, and therefore there are still products offering even more competitive rates and packages on offer. The support and advice of a broker in finding the best option for an individual’s circumstance and in helping to assess their eligibility has likely never been more vital as the mortgage landscape remains extremely changeable.”

Eleanor Williams, Finance Expert at Moneyfacts, said:

“Following a statement from the FCA last week urging eligible borrowers to consider their mortgage options and switch to a more cost-effective deal in order to save money where possible, Moneyfacts data shows that those considering a new mortgage may wish to move swiftly to achieve this.

“Mortgage availability has dropped again this month, admittedly reducing at a less dramatic rate than recorded last month. August began with sight of 4,407 mortgages on offer, which is 149 fewer than were available at the start of July, meaning that the level of choice for borrowers has fallen again. Not only are there now fewer deals for borrowers to choose from, but the average shelf life for mortgage deals has plummeted to a new low of just 17 days this month. This reflects the speed at which providers are updating their offerings, but also means that those looking for a new mortgage have the shortest length of time we have ever recorded to try to secure their deal of choice.

“Would-be borrowers will also note that the rates on offer are continuing to climb. The average overall five-year fixed rate mortgage has breached 4% for the first time in nearly eight years, reaching 4.08% this month, a high not seen since October 2014 (4.08%). The average two-year overall rate, currently 3.95% after another month-on-month increase, is the highest recorded in over nine years (Feb 2013 – 4.09%). However, the average SVR has also climbed, this month rising by 0.11% to 5.17%, so while the differential between this and the average fixed rates now available has shrunk, it’s clear that those on, or about to revert to an SVR, could save on their monthly mortgage repayments if they are able to lock into a new fixed deal.

“The amount a borrower might be able to save on a new mortgage will depend on many factors, and it’s important consumers remember that average rates reflect what’s available across the whole of the market, and therefore there are still products offering even more competitive rates and packages on offer. The support and advice of a broker in finding the best option for an individual’s circumstance and in helping to assess their eligibility has likely never been more vital as the mortgage landscape remains extremely changeable.”