Eleanor Williams, Finance Expert at Moneyfacts, said:

“Product choice took another dip this month as mortgage lenders continue to revise their ranges in the face of ongoing economic uncertainty. We have seen some providers pull selected products, while others have withdrawn whole sectors of, or indeed their entire ranges, from the market temporarily. Compared to last month, total availability has reduced by a notable 431 deals to leave 4,556 mortgage products on offer to borrowers this month. This is just 44 more deals than were available this time last year, although at just 23 days the product shelf-life is seven days shorter than the 30 days this stood at in July 2021, reflecting the current pace of provider updates.

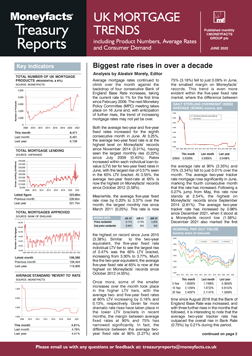

“As product ranges have condensed, average fixed rates have continued on an upwards trajectory, with two- and five-year fixed averages at all loan-to-value (LTV) tiers rising this month. The average overall two- and five-year fixed rates have increased by 0.49% and 0.52%, to sit at 3.74% and 3.89% respectively. These are the largest ever monthly rate rises recorded at Moneyfacts, on our data which tracks back to 2007.

“There are numerous factors which affect fixed rate pricing, rather than it simply tracking the Bank of England base rate. Providers take into account many influences, such as funding, swap rates, pricing pressures from other providers, and being able to maintain their service levels, among others. Having said that, it is interesting to note that in the period between December 2021 and July 2022, base rate has risen from 0.10% to 1.25% - an increase of 1.15% in total. Over this same period, the average overall two-year fixed rate has risen by 1.40% to sit at 3.74%. The equivalent five-year fixed overall rate has gone up to 3.89%, a 1.25% rise when compared to the 2.64% this sat at in December 2021.

“As might be expected following the recent base rate rises from the Bank of England, the average SVR has also risen and at 5.06% is now above 5% for the first time since January 2009. Although the difference between this rate and the average fixed rates has reduced in recent months, for eligible borrowers about to fall onto a revert rate, the incentive to lock into a new fixed deal is still clear. Those switching from the average SVR to the current average two-year fixed rate might be able to make monthly savings of nearly £150*. While we remain in a cost of living crisis, with pressure on many household budgets, it’s vital prospective borrowers explore their options and are not disheartened by recent rate rises. There are products in our top tables with even more competitive rates still available, and therefore some could possibly reduce their outgoings on their mortgage by even more.”

*Based on a mortgage balance of £200,000 over a 25-year term, comparing potential monthly repayments at a rate of 5.06% vs at 3.74%.

Eleanor Williams, Finance Expert at Moneyfacts, said:

“Product choice took another dip this month as mortgage lenders continue to revise their ranges in the face of ongoing economic uncertainty. We have seen some providers pull selected products, while others have withdrawn whole sectors of, or indeed their entire ranges, from the market temporarily. Compared to last month, total availability has reduced by a notable 431 deals to leave 4,556 mortgage products on offer to borrowers this month. This is just 44 more deals than were available this time last year, although at just 23 days the product shelf-life is seven days shorter than the 30 days this stood at in July 2021, reflecting the current pace of provider updates.

“As product ranges have condensed, average fixed rates have continued on an upwards trajectory, with two- and five-year fixed averages at all loan-to-value (LTV) tiers rising this month. The average overall two- and five-year fixed rates have increased by 0.49% and 0.52%, to sit at 3.74% and 3.89% respectively. These are the largest ever monthly rate rises recorded at Moneyfacts, on our data which tracks back to 2007.

“There are numerous factors which affect fixed rate pricing, rather than it simply tracking the Bank of England base rate. Providers take into account many influences, such as funding, swap rates, pricing pressures from other providers, and being able to maintain their service levels, among others. Having said that, it is interesting to note that in the period between December 2021 and July 2022, base rate has risen from 0.10% to 1.25% - an increase of 1.15% in total. Over this same period, the average overall two-year fixed rate has risen by 1.40% to sit at 3.74%. The equivalent five-year fixed overall rate has gone up to 3.89%, a 1.25% rise when compared to the 2.64% this sat at in December 2021.

“As might be expected following the recent base rate rises from the Bank of England, the average SVR has also risen and at 5.06% is now above 5% for the first time since January 2009. Although the difference between this rate and the average fixed rates has reduced in recent months, for eligible borrowers about to fall onto a revert rate, the incentive to lock into a new fixed deal is still clear. Those switching from the average SVR to the current average two-year fixed rate might be able to make monthly savings of nearly £150*. While we remain in a cost of living crisis, with pressure on many household budgets, it’s vital prospective borrowers explore their options and are not disheartened by recent rate rises. There are products in our top tables with even more competitive rates still available, and therefore some could possibly reduce their outgoings on their mortgage by even more.”

*Based on a mortgage balance of £200,000 over a 25-year term, comparing potential monthly repayments at a rate of 5.06% vs at 3.74%.