Rachel Springall, Finance Expert at Moneyfacts, said:

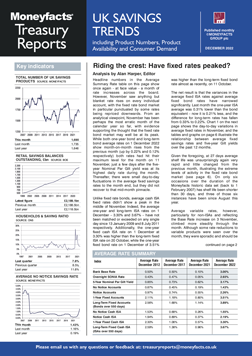

“Savings rates are now at their highest levels in over a decade, a significant milestone. In 2021, all average savings rates fell to record lows, so it’s positive to see notable improvements across the savings spectrum this year. A combination of reasons has been at play for interest rates to rise at such pace, one being the consecutive base rate rises by the Bank of England throughout 2022, but also increased competition among challenger banks. Indeed, one area of the market to see rates reach the highest levels since 2008 was one-year fixed rate bonds, a popular arena for challenger banks seeking savers’ deposits to fund their future lending. Savers coming off a one-year bond will note the average rate has risen by 2.71% since December 2021 and the average rate on a one-year fixed ISA has risen by 2.73% over the same period.

“The month-on-month rises between the average fixed bond and fixed ISA rates between the start of November and December was more subdued compared to the month prior, demonstrating a more muted attitude among providers re-pricing their deals. This change in momentum may see rates move in the opposite direction as we enter 2023, as savings providers reassess their market positions during an unprecedented period of interest rate uncertainty. If providers cut back their rates, it can lead to other brands being more exposed on the top rate tables, leading to further cuts.

“Those savers who are more comfortable with a variable rate than a fixed rate bond or ISA may be pleased to see how much this area of the market has improved throughout 2022. Average variable rates across easy access, notice and ISA equivalents experienced the biggest month-on-month rises on our records, with the notice account and notice ISA rates breaching 2% for the first time since December 2008. However, while these rises should be celebrated, the cost of living crisis is having an impact on savers’ attitudes towards keeping money resting in a flexible pot. According to the Bank of England, there was an outflow of almost £5 billion from interest-bearing sight deposits in October, a clear sign that consumers are pulling money out of flexible accounts, but at the same time, there was demand for fixed accounts recording an inflow of £11.3 billion into time deposits. Moving into 2023, savers and providers alike will need to act quickly to keep on top of the changing market.”

Rachel Springall, Finance Expert at Moneyfacts, said:

“Savings rates are now at their highest levels in over a decade, a significant milestone. In 2021, all average savings rates fell to record lows, so it’s positive to see notable improvements across the savings spectrum this year. A combination of reasons has been at play for interest rates to rise at such pace, one being the consecutive base rate rises by the Bank of England throughout 2022, but also increased competition among challenger banks. Indeed, one area of the market to see rates reach the highest levels since 2008 was one-year fixed rate bonds, a popular arena for challenger banks seeking savers’ deposits to fund their future lending. Savers coming off a one-year bond will note the average rate has risen by 2.71% since December 2021 and the average rate on a one-year fixed ISA has risen by 2.73% over the same period.

“The month-on-month rises between the average fixed bond and fixed ISA rates between the start of November and December was more subdued compared to the month prior, demonstrating a more muted attitude among providers re-pricing their deals. This change in momentum may see rates move in the opposite direction as we enter 2023, as savings providers reassess their market positions during an unprecedented period of interest rate uncertainty. If providers cut back their rates, it can lead to other brands being more exposed on the top rate tables, leading to further cuts.

“Those savers who are more comfortable with a variable rate than a fixed rate bond or ISA may be pleased to see how much this area of the market has improved throughout 2022. Average variable rates across easy access, notice and ISA equivalents experienced the biggest month-on-month rises on our records, with the notice account and notice ISA rates breaching 2% for the first time since December 2008. However, while these rises should be celebrated, the cost of living crisis is having an impact on savers’ attitudes towards keeping money resting in a flexible pot. According to the Bank of England, there was an outflow of almost £5 billion from interest-bearing sight deposits in October, a clear sign that consumers are pulling money out of flexible accounts, but at the same time, there was demand for fixed accounts recording an inflow of £11.3 billion into time deposits. Moving into 2023, savers and providers alike will need to act quickly to keep on top of the changing market.”