Rachel Springall, Finance Expert at Moneyfacts, said:

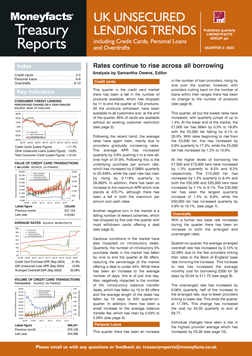

“The cost to borrow is on the rise across credit cards and unsecured personal loans, which will come as disappointing news to consumers. Borrowers now have fewer 0% interest-free credit card offers to choose from and less time to repay their debts before interest applies. The availability of credit cards that offer a 0% interest-free balance transfer deal has fallen to its lowest point in two years, and the average term to repay debts before interest applies is at its lowest since March 2021. These drops may well be down to a more cautious outlook by providers amid a cost of living crisis.

“Unsecured personal loans remain a good option for borrowers to consolidate their debts, but year-on-year the average rate on a loan of £10,000 with a repayment term of five years has risen by around 3%, which now costs almost £800 more in interest over a five-year term compared to a loan taken out in September 2022. There are other alternatives to these loans, such as credit cards, but these allow borrowers to be more flexible with their repayments, which may not be suitable for those who need a stricter plan to get out of debt.

“The average balance transfer fee has also risen, which now costs borrowers more to move their debts to a 0% balance transfer offer and stands at its highest point since November 2020. Borrowers looking to consolidate their debts would be wise to carefully compare these upfront fees and the length of any 0% offer before they commit, and perhaps consider cards that do not charge an upfront fee. Lenders typically increase the cost to borrow when the potential risk for borrowers to default is elevated.

“Consumers looking for a new credit card, perhaps for them to spread the cost of their purchases in the run-up to the festive season, would be wise to compare deals now. It’s also important they take time to check their credit score before they apply. If borrowers are struggling with their debts, it is imperative they speak to their provider and seek advice if they are worried about missing any repayments.”

Rachel Springall, Finance Expert at Moneyfacts, said:

“The cost to borrow is on the rise across credit cards and unsecured personal loans, which will come as disappointing news to consumers. Borrowers now have fewer 0% interest-free credit card offers to choose from and less time to repay their debts before interest applies. The availability of credit cards that offer a 0% interest-free balance transfer deal has fallen to its lowest point in two years, and the average term to repay debts before interest applies is at its lowest since March 2021. These drops may well be down to a more cautious outlook by providers amid a cost of living crisis.

“Unsecured personal loans remain a good option for borrowers to consolidate their debts, but year-on-year the average rate on a loan of £10,000 with a repayment term of five years has risen by around 3%, which now costs almost £800 more in interest over a five-year term compared to a loan taken out in September 2022. There are other alternatives to these loans, such as credit cards, but these allow borrowers to be more flexible with their repayments, which may not be suitable for those who need a stricter plan to get out of debt.

“The average balance transfer fee has also risen, which now costs borrowers more to move their debts to a 0% balance transfer offer and stands at its highest point since November 2020. Borrowers looking to consolidate their debts would be wise to carefully compare these upfront fees and the length of any 0% offer before they commit, and perhaps consider cards that do not charge an upfront fee. Lenders typically increase the cost to borrow when the potential risk for borrowers to default is elevated.

“Consumers looking for a new credit card, perhaps for them to spread the cost of their purchases in the run-up to the festive season, would be wise to compare deals now. It’s also important they take time to check their credit score before they apply. If borrowers are struggling with their debts, it is imperative they speak to their provider and seek advice if they are worried about missing any repayments.”