Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said:

“As consumers fear for their investments and pension pots over stock market turmoil, it’s important they take time to seek advice and ensure they are comfortable with their future goals so that they do not make any knee-jerk reactions they might come to regret later down the line. In terms of how mortgage borrowers and cash savers may be affected, it is worth pointing out that lenders and savings providers will be watching markets closely right now, such as swap rates, to see how such volatility will play a part in their pricing strategies. As it stands, product choice for consumers across savings and mortgages is thriving, but should there be an unexpected dip, these markets have demonstrated how they can bounce back and overcome years of turmoil.

“Five years ago, the COVID-19 pandemic and UK lockdown set in motion an unprecedented situation for consumers. Not only did this impact people’s everyday lives, but the turmoil caused havoc for lenders and savings providers. Whether someone was buying a home or saving a pot for their future goals, the years that ensued where challenging to say the least. Those consumers looking at their current situation would do well to make every effort to budget and save to help them cover any unexpected costs. Thankfully, there was a rise to the households’ savings ratio, according to the Office for National Statistics (ONS) during Q4 2024, up to 12% from 10.3% the previous quarter. This is a record high outside of the significant jumps seen around the UK lockdown.”

Mortgages

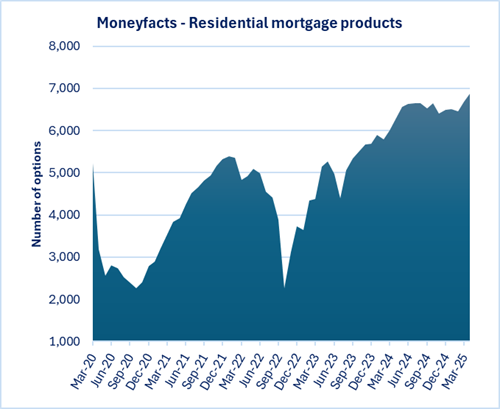

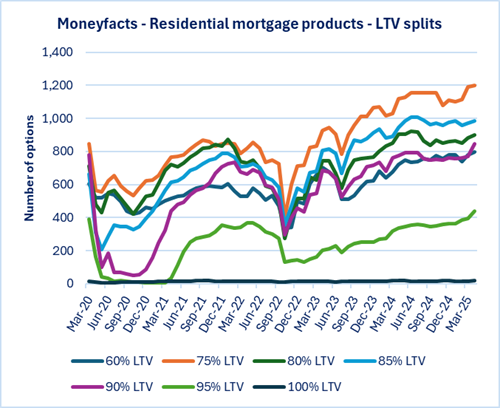

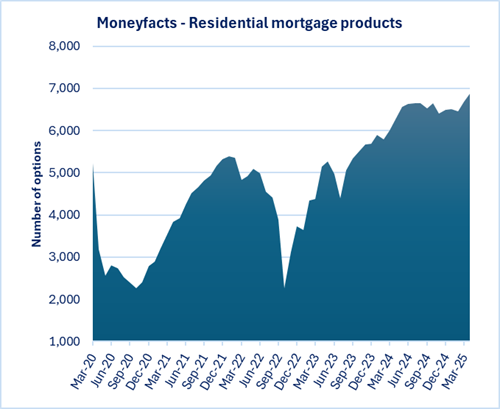

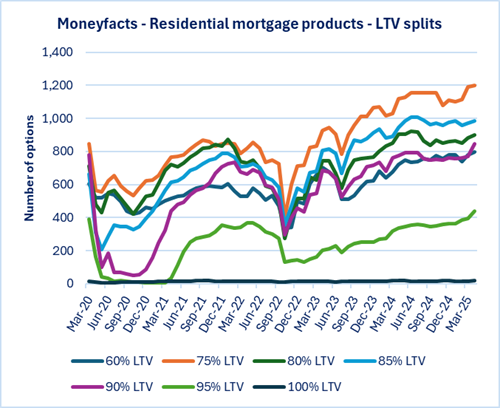

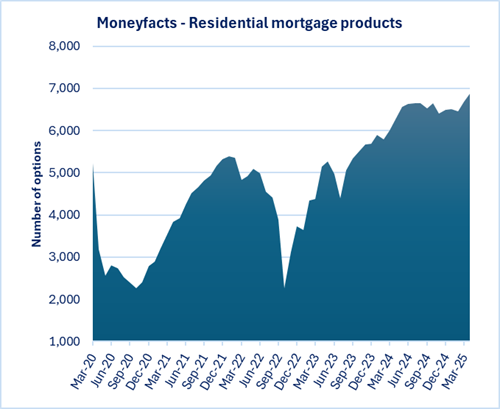

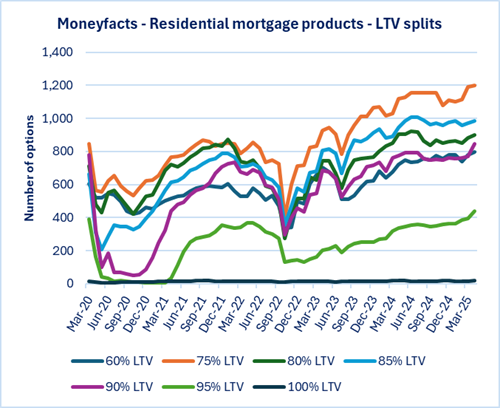

“There is an abundance of choice for mortgage borrowers, and there is a big expectation for lenders to do more to stimulate UK growth. The positive recovery in mortgage choice comes after a dramatic five years of ups and downs. Mortgage product choice nosedived after the UK entered lockdown in March 2020, with over 2,000 deals lost, more than halving the number of residential mortgages on sale between the start of March and May 2020. Lenders sought to support their existing customers amid the crisis, such as those unable to work or furloughed. On the other hand, lenders reined in their intentions to lend out to new buyers, such as first-time buyers with small deposits as they reassessed their level of risk, but as a result it took five years for the quantity of deals at 95% loan-to-value to recover. Overall, it took several months for overall product choice to breach 5,000 options, (November 2021 – 5,156).

“As time marched on, both the UK and the mortgage market started to get back to business, and the Bank of England base rate eventually rose from its record low of 0.10% to 0.25% in December 2021. Several base rate increases followed as inflation started to rise at a worrying pace, but no-one was prepared for market turmoil soon to come. During the latter part of 2022, product choice saw another damaging monthly fall, of 1,632 deals between September and October 2022, which came as the fiscal announcement, or ‘mini-Budget’, was delivered on 23 September 2022. Six months later, choice breached 5,000 deals and the number of deals at 95% loan-to-value breached 200. The market today for borrowers with limited deposits has improved, and despite the end of Stamp Duty Land Tax (SDLT) relief last month, lenders have been working hard to entice new business, with some even offering cashback in the thousands to support buyers. Affordability remains a key issue for buyers, so saving for a large deposit can still feel like an uphill struggle, so choosing the right savings account is essential.”

Savings

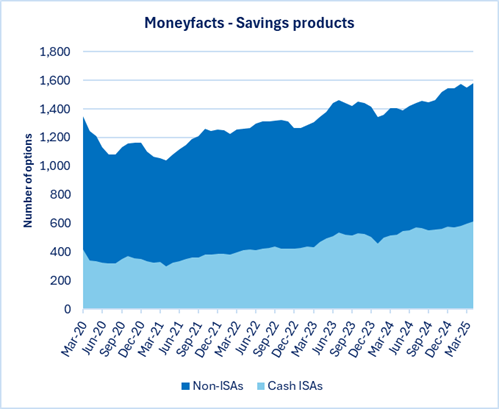

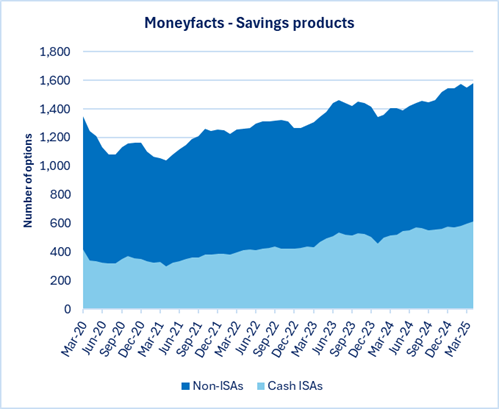

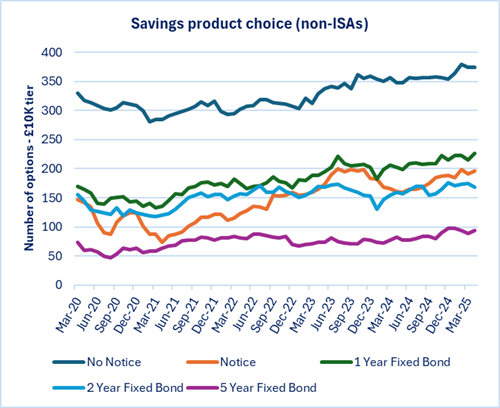

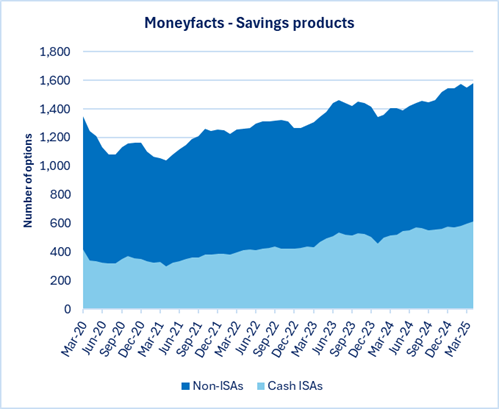

“The savings market has had its fair share of turmoil over the past five years, so it wouldn’t be too surprising to find some savers feeling slightly apathetic when it comes to chasing down the best interest rates. The UK lockdown in March 2020 did impact the overall choice of savings accounts (including cash ISAs), as there was a loss of 220 deals between the start of March and May 2020, falling from 1,768 to 1,548. It took more than two years for the choice of deals to recover, reaching 1,816 in April 2023. This slow recovery emphasises the hardship of savers, not only blighted by a dip in choice, but also impacted by the emergency back-to-back base rate cuts by the Bank of England in March 2020, bringing the rate to a record low of 0.10%. It took two years for the base rate to return to 0.75% (March 2022), but the damage had already been done, and the choice of savings deals fell to a record low of 1,340 in April 2021.

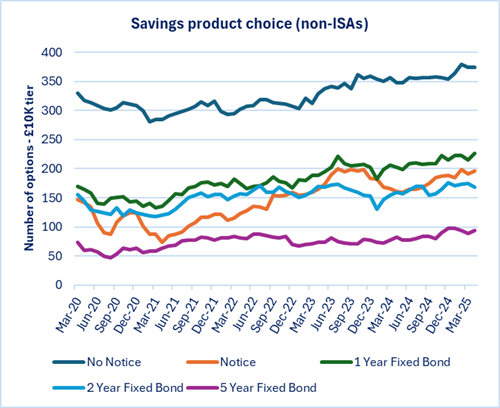

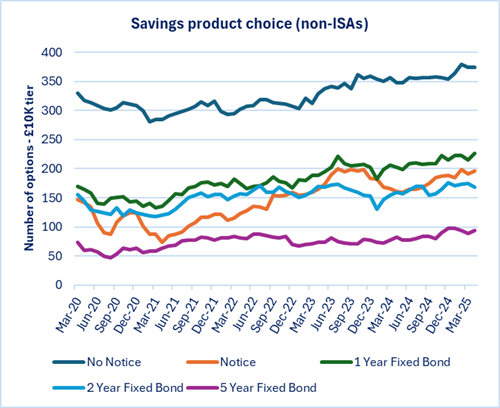

“Regardless of the type of savings account consumers sought, product choice felt the shocks of the worldwide pandemic and, as time moved on to 2022, savers watched their pots lose value in real terms, as inflation soared (11.1% CPI for October 2022). Savers may change their behaviours in times of turmoil, such as moving money out of an easy access account and reinvesting it into a fixed rate bond. Fixed rate bonds provide a guaranteed return, so they continue to be a haven for savers’ cash, weathering the storm of fluctuating interest rates. One-year bonds remain more abundant than their longer-term rivals, and challenger banks typically offer the best returns. However, as interest rates remain unpredictable, a longer-term bond could become a more popular choice in the months ahead.

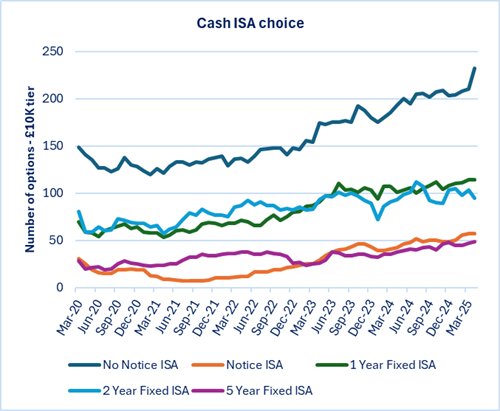

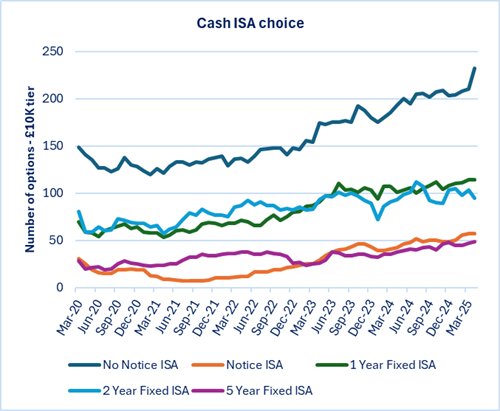

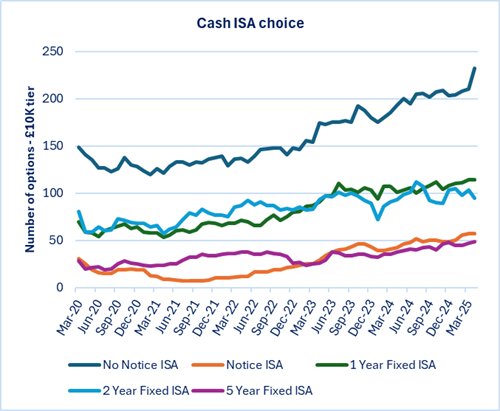

“Cash ISAs continue to thrive and will no doubt be vital for savers to utilise both now and in the future, particularly for those moving up from a basic-rate taxpayer to a higher-rate taxpayer, subsequently seeing their £1,000 Personal Savings Allowance (PSA) halved to £500. There are over 600 cash ISAs on the market, which is a record high, so there is a good amount of choice for savers looking to protect their hard-earned cash from tax.”

Supporting charts: The supporting charts below show volatility in product choice across the residential mortgage market and savings market – starting 1 March 2020 to 1 April 2025.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said:

“As consumers fear for their investments and pension pots over stock market turmoil, it’s important they take time to seek advice and ensure they are comfortable with their future goals so that they do not make any knee-jerk reactions they might come to regret later down the line. In terms of how mortgage borrowers and cash savers may be affected, it is worth pointing out that lenders and savings providers will be watching markets closely right now, such as swap rates, to see how such volatility will play a part in their pricing strategies. As it stands, product choice for consumers across savings and mortgages is thriving, but should there be an unexpected dip, these markets have demonstrated how they can bounce back and overcome years of turmoil.

“Five years ago, the COVID-19 pandemic and UK lockdown set in motion an unprecedented situation for consumers. Not only did this impact people’s everyday lives, but the turmoil caused havoc for lenders and savings providers. Whether someone was buying a home or saving a pot for their future goals, the years that ensued where challenging to say the least. Those consumers looking at their current situation would do well to make every effort to budget and save to help them cover any unexpected costs. Thankfully, there was a rise to the households’ savings ratio, according to the Office for National Statistics (ONS) during Q4 2024, up to 12% from 10.3% the previous quarter. This is a record high outside of the significant jumps seen around the UK lockdown.”

Mortgages

“There is an abundance of choice for mortgage borrowers, and there is a big expectation for lenders to do more to stimulate UK growth. The positive recovery in mortgage choice comes after a dramatic five years of ups and downs. Mortgage product choice nosedived after the UK entered lockdown in March 2020, with over 2,000 deals lost, more than halving the number of residential mortgages on sale between the start of March and May 2020. Lenders sought to support their existing customers amid the crisis, such as those unable to work or furloughed. On the other hand, lenders reined in their intentions to lend out to new buyers, such as first-time buyers with small deposits as they reassessed their level of risk, but as a result it took five years for the quantity of deals at 95% loan-to-value to recover. Overall, it took several months for overall product choice to breach 5,000 options, (November 2021 – 5,156).

“As time marched on, both the UK and the mortgage market started to get back to business, and the Bank of England base rate eventually rose from its record low of 0.10% to 0.25% in December 2021. Several base rate increases followed as inflation started to rise at a worrying pace, but no-one was prepared for market turmoil soon to come. During the latter part of 2022, product choice saw another damaging monthly fall, of 1,632 deals between September and October 2022, which came as the fiscal announcement, or ‘mini-Budget’, was delivered on 23 September 2022. Six months later, choice breached 5,000 deals and the number of deals at 95% loan-to-value breached 200. The market today for borrowers with limited deposits has improved, and despite the end of Stamp Duty Land Tax (SDLT) relief last month, lenders have been working hard to entice new business, with some even offering cashback in the thousands to support buyers. Affordability remains a key issue for buyers, so saving for a large deposit can still feel like an uphill struggle, so choosing the right savings account is essential.”

Savings

“The savings market has had its fair share of turmoil over the past five years, so it wouldn’t be too surprising to find some savers feeling slightly apathetic when it comes to chasing down the best interest rates. The UK lockdown in March 2020 did impact the overall choice of savings accounts (including cash ISAs), as there was a loss of 220 deals between the start of March and May 2020, falling from 1,768 to 1,548. It took more than two years for the choice of deals to recover, reaching 1,816 in April 2023. This slow recovery emphasises the hardship of savers, not only blighted by a dip in choice, but also impacted by the emergency back-to-back base rate cuts by the Bank of England in March 2020, bringing the rate to a record low of 0.10%. It took two years for the base rate to return to 0.75% (March 2022), but the damage had already been done, and the choice of savings deals fell to a record low of 1,340 in April 2021.

“Regardless of the type of savings account consumers sought, product choice felt the shocks of the worldwide pandemic and, as time moved on to 2022, savers watched their pots lose value in real terms, as inflation soared (11.1% CPI for October 2022). Savers may change their behaviours in times of turmoil, such as moving money out of an easy access account and reinvesting it into a fixed rate bond. Fixed rate bonds provide a guaranteed return, so they continue to be a haven for savers’ cash, weathering the storm of fluctuating interest rates. One-year bonds remain more abundant than their longer-term rivals, and challenger banks typically offer the best returns. However, as interest rates remain unpredictable, a longer-term bond could become a more popular choice in the months ahead.

“Cash ISAs continue to thrive and will no doubt be vital for savers to utilise both now and in the future, particularly for those moving up from a basic-rate taxpayer to a higher-rate taxpayer, subsequently seeing their £1,000 Personal Savings Allowance (PSA) halved to £500. There are over 600 cash ISAs on the market, which is a record high, so there is a good amount of choice for savers looking to protect their hard-earned cash from tax.”

Supporting charts: The supporting charts below show volatility in product choice across the residential mortgage market and savings market – starting 1 March 2020 to 1 April 2025.